No, Bitcoin Is Not Making A Comeback

We now see roughly one additional Bitcoin transaction for every $100 in venture capital.

Vox recently wrote about the recent surge in the price of Bitcoins. Transaction volume and venture capital investment are also growing. Vox characterized these trends as signs of progress, especially in contrast to the dramatic decline over the prior eighteen months. However, there’s an alternative explanation: a flood of venture capital is propping up Bitcoin, while generating almost no return on capital.

Market Cap Vs. VC Investment

We’ve written at length about the flaws and misunderstandings that surround Bitcoin. Is it possible that, in spite of everything, including a recent fork in the blockchain, that Bitcoin is poised for a comeback?

Well, no.

Payment networks based on public-key encryption and consensus protocols are the future of commerce. But it remains unlikely that Bitcoin is more than a precursor. And the recent trends in price and transaction volume don’t change that.

Consider the growth in market capitalization relative

to the venture capital investment.

The market capitalization of Bitcoin since January 1st, 2014, to date,

dropped from $9.78B to $6.57B as of this writing.

Venture investment reached $799M over the same period.

Consequently, we’d expect Bitcoin’s market cap to be over $10.5B,

even if each dollar of investment generated a dollar increase in market cap.

But, even including Monday’s surge,

Bitcoin’s market cap has dropped $3.21B over that same period.

All told, that’s over four billion dollars in value that’s just…gone.

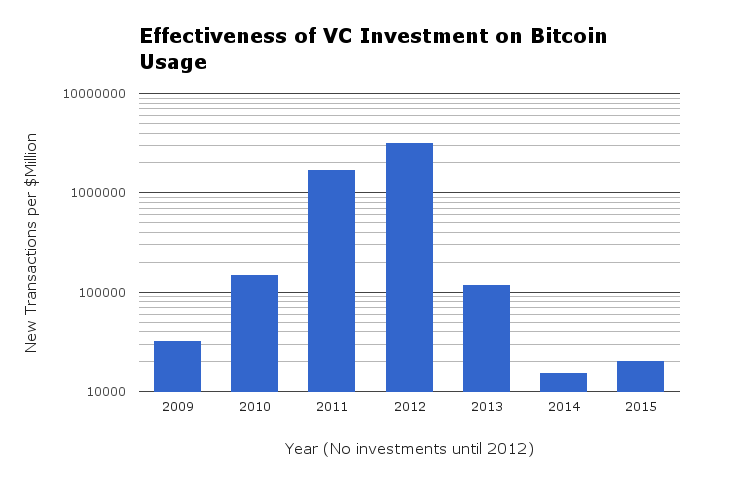

Transaction Volume Vs. VC Investment

However, the Vox article wisely warns us not to put too much faith in Bitcoin’s highly volatile market cap. Instead, they prefer to look at the steady growth in the transaction volume.

However, the “slow - though not spectacular” increase in transaction volume

is meager in contrast to the venture capital investment.

The transaction growth per dollar of venture investment remains

an order of magnitude lower than in 2013.

We see roughly one additional Bitcoin transaction

for every $100 in venture capital.

Will VCs Continue To Invest?

Venture capital flocked to Bitcoin based on the spectular growth, in both market cap and transaction volume, Bitcoin enjoyed in 2013. However, that investment does not appear to have done much to stimulate the Bitcoin economy. Will investors continue to pour money into a market which, outside of a recent two day spike, has stagnated?

The magnitude of the investment in venture capital is hardly the promising sign Vox makes it out to be. Nearly a billion dollars has been poured into Bitcoin startups over the past three years. Next to this investment, the net drop in market cap and modest increase in transaction volume, are, at best, meaningless.

Wanted: Bitcoin’s Successor

Most of those same startups are prepared (or preparing) for the emergence of alternative networks. What that venture capital investment represents, more than anything, is the development of expertise around consensus protocols, payment networks, and the myriad challenges to their adoption. Perhaps Vox is right to be optimistic about Bitcoin. If not, you can be sure the venture funds are hedging their bets, keeping an eye on alternative payment networks.